DeFi Wealth Strategies Institutions Don’t Want You to Know About

How to Make Life Changing Passive Yields Amidst Institutional Altcoin Season

Right now, we’re living through one of the most lucrative phases in crypto — and most people don’t even realize it. With the recent surge in Bitcoin and Ethereum prices, decentralized finance (DeFi) is quietly experiencing a renaissance. Transaction volume is spiking across major decentralized exchanges (DEX’s), while yield farming opportunities are offering triple and quadruple-digit returns. And the craziest part? Institutional capital still isn’t even here yet. Due to regulatory barriers and compliance concerns, large financial institutions haven’t fully entered DeFi — yet. That means what we’re witnessing is a retail-driven wave of momentum, and it’s only the beginning.

To understand why this moment is so important, you first need to understand what yield farming really is. Yield farming is just a DeFi-native version of what traditional market makers have been doing for centuries. Market makers facilitate buying and selling by providing liquidity — which allows them to earn fees every time someone makes a buy or sell trade. In the same way, when you provide liquidity to a DEX, you earn a cut of the trading volume in the form of fees, rewards, or both. This is the backbone of financial markets — and now for the first time in history, individuals like you and I can take part in it directly.

In this article, you’re going to learn exactly why DeFi yields are so strong right now, how market making works, how this strategy thrives in all market conditions, and why we believe the opportunity in front of us is generational. We’ll also walk you through how you can begin implementing these strategies yourself, and how to join our upcoming virtual event where we’ll teach everything in real-time and show the results we’ve been getting.

Historically, market makers have had the best-performing portfolios over time — not because they predicted the right coins or called the tops and bottoms, but because they captured fees from consistent trading activity. It doesn’t matter if the market is pumping or dumping — someone is always buying and someone is always selling. That activity creates volume, and that volume creates fees. As a market maker (or liquidity provider in DeFi), you’re not betting on direction. You’re getting paid to let others bet, while you profit from the game itself. This is why liquidity provision is one of the most sustainable and battle-tested passive income strategies in finance.

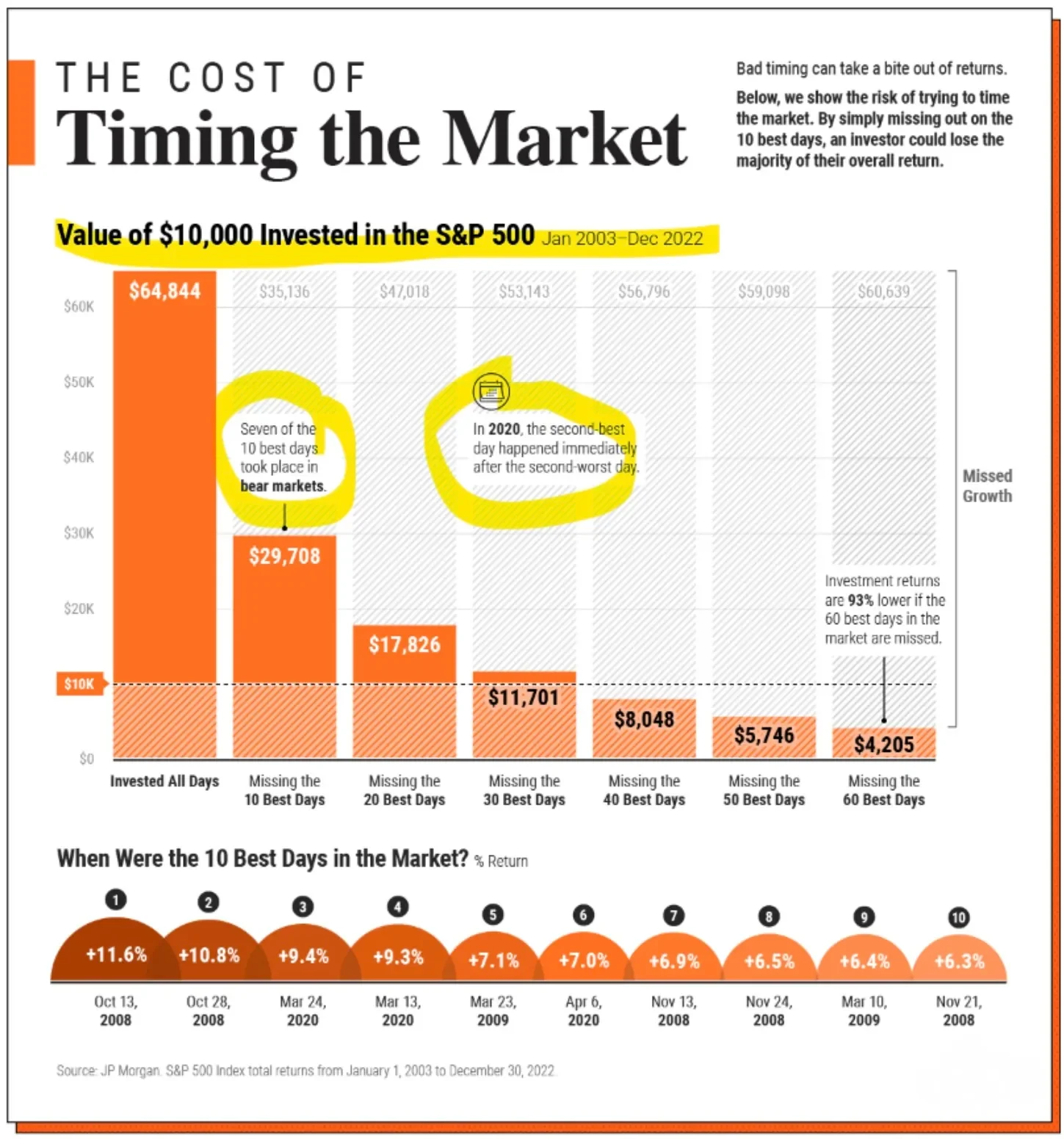

There’s another key principle that separates pros from amateurs: time in the market beats trying to time the market. Study after study confirms that trying to perfectly enter or exit markets causes far more harm than good. Refer to the picture below to see how your portfolio's performance would’ve been drastically affected by missing just the 10 best days in the stock market in a 9 year time span. The data shows that long-term presence in high-potential markets outperforms even the most advanced trading strategies.

In DeFi, this also holds especially true: consistent participation in high-volume liquidity pools can yield outsized returns, even if you don’t perfectly predict price action. But the most important thing is that you have to be providing liquidity during the best days which are days with large amounts of buying and selling volume.

And here's what makes this moment even more important: we’re not even close to the top. Ethereum hasn’t touched its previous all-time highs. Total Value Locked (TVL) across DeFi protocols is still significantly below 2021 levels (see picture below). The infrastructure is more advanced than ever, the user experience is improving, and major legislation — like the recently passed GENIUS Act and the Financial Clarity Act — is giving institutions the green light to finally enter the crypto space. With legal clarity, banks, asset managers, and hedge funds can now begin participating in the ecosystem they’ve been cautiously circling for years.